U.S. Economic Growth May Actually be Slowing

In my speeches, classes, or whenever I am asked about the state of the economy, I will frequently stress the need to look behind the headline economic numbers to get a better sense of what is happening in the economy and where it might be headed. This is arguably more important during these extraordinarily uncertain economic times, as illustrated by the current release of the U.S. real gross domestic product (GDP) figures.

U.S. real gross domestic product grew by 3.0% in the second quarter of this year. This follows a decline of 0.5% in the first quarter (U.S. Bureau of Economic Analysis). While the growth in the second quarter seems to indicate the economy has rebounded from the decline in the first quarter, it is necessary to look a bit deeper in the figures because these big swings in growth were driven by historically large changes in net exports. More specifically, it was large changes in imports as business substantially increased their imports in the first quarter to get ahead of the tariffs and then pulled back in the second quarter. This is shown in the following chart of the contribution in percent change in real gross domestic product attributed to net exports. The data in the chart go back to the fourth quarter of 1947 covering all data available, The contribution in percent change in real gross domestic product derived from net exports was -4.61 in the the first quarter of this year and 4.99 in the second quarter. It is clear from the graph that these are the largest swings in the contribution of net exports to the change in GDP in history. Net exports are the value of exports minus the value of imports, so the negative contribution of net exports in the first quarter is due to the very large increase in imports and the reverse of that in the second quarter.

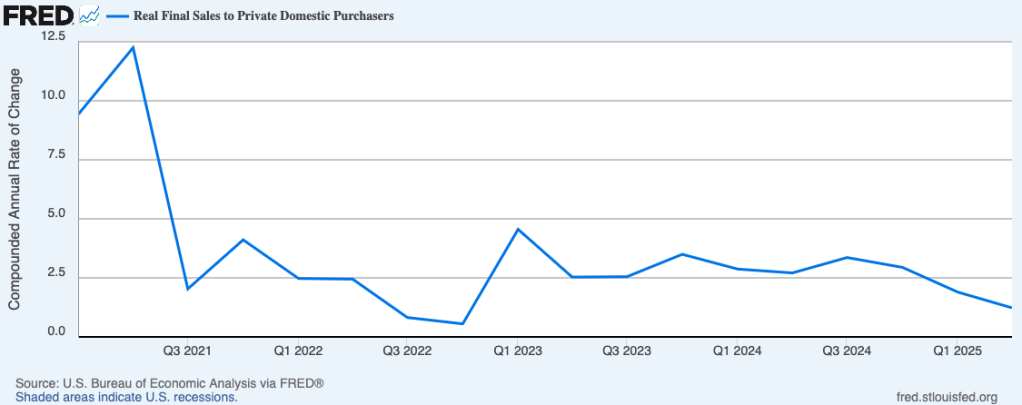

To get a clearer picture of how the economy grew over the first two quarters of 2025, we need to look at the change in real final sales to private domestic purchasers calculated as “the sum of consumer spending and gross private fixed investment [i.e., capital expenditures]” (U.S. Bureau of Economic Analysis). This removes the volatile components of GDP – net exports and inventories – and provides a “cleaner” measure of private domestic demand with a focus on domestic demand since net exports are removed.

The following graph shows the growth in real final sales to private domestic purchasers for each quarter since the first quarter of 2021. The picture of economic growth looks vastly different by this measure, since it has declined in each quarter since the third quarter of 2024. In the first quarter of 2025 real final sales to domestic purchasers grew 1.9%, but the growth rate declined to 1.2% in the second quarter (U.S. Bureau of Economic Analysis).

Contrary to what the headline GDP figures show for this quarter, trends in private domestic demand indicate U.S. economic growth may actually be slowing.